Second, the net pension liability (NPL) was $174,066 (page 7 of Attachment 1). This is the amount the plan is currently underfunded.

However, perhaps these figures seem small. After all, the government just has to raise taxes a “little bit” to raise the necessary funds from the people. Well, the NPL assumes that the fund performs at an annual investment rate of return of +7.5%. If the annual rate of return drops even just to +6.5%, the new pension liability leaps to $305,119 (page 4 of Attachment 1).

Well, that can’t happen, you may say. Governments are really smart and know how to invest money in the stock market, or at least hire a competent investment firm that won’t flee with the tax money. On page 4 is the annual money-weighted rate of return, net of investment expenses for 2015, a loss of 3.6%. If a 1% decrease from 7.5% is ~$131k, how much are taxpayers responsible for with a ~11% difference (7.5% + 3.6%)? Of course if the stock market has a market crash, Barrett taxpayers will be on the hook for much, MUCH more than $305,119.

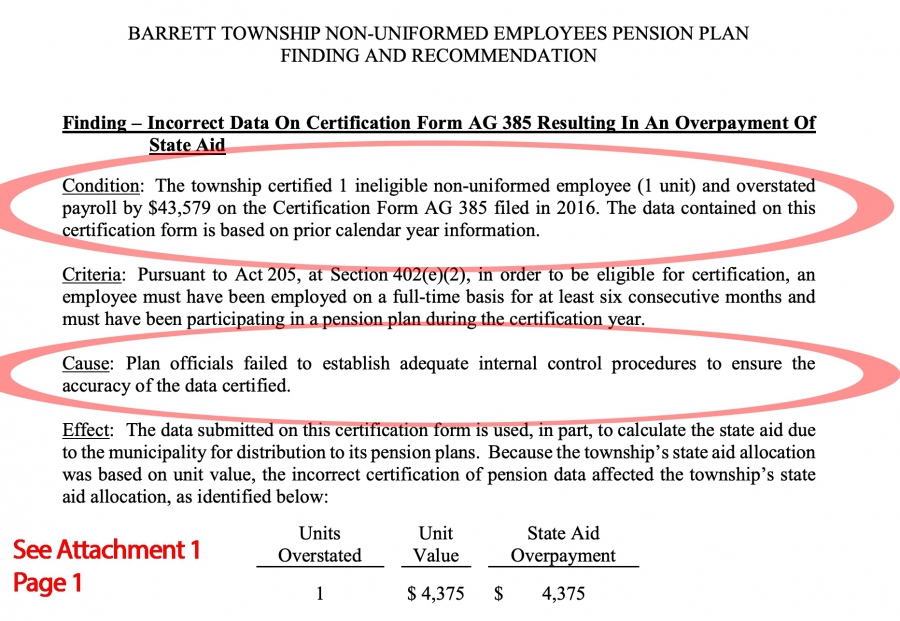

- Condensed State Audit (Attachment 1)

- Barrett Township Non-Uniformed Defined Benefit Plan 8.0 (Attachment 2)

Here are a few facts...

...as I understand them (although there are special rules for bureaucrats’ early retirement, survivor benefits, etc. See Attachment 2)

- All full-time municipal government workers are eligible.

- Once obtaining 5 years of service, all bureaucrats are 100% vested. (I don’t see any partial vestment, i.e. if a bureaucrat leaves before hitting 5 years, I do not believe they receive a pension.)

- The monthly payout uses the bureaucrat’s latest 3 years compensation which is called the “Average Monthly Compensation” (AMC).

- To determine the bureaucrat’s monthly pension, the “Average Monthly Compensation” is multiplied by 1.5% and the number of years of service. (I.e. a bureaucrat serving the minimum 5 years for full vesting would receive a monthly pension of 7.5% of their AMC for the rest of their life.) (See Attachment 2)

- The bureaucrat does not contribute to the pension fund at any time.

- As of January 2019, the plan had 16 active members.

- The pension fund appears to have been initially created in 1986 (See Barrett Township Ordinance #91)

To set up a real-life example, let’s say a township employee has been employed 20 years of service which would mean a payout of 1.5% x 20 or 30% of the average monthly compensation. Let’s assume this employee was receiving an average salary of $60,000 per year for the last 3 years of their employment. Therefore, upon retirement this employee will probably be paid around $1500 per month or $18,000 per year.

Next Steps...?

Perhaps the township should consider ending the pension plan, especially for new employees and perhaps offering a tax-advantage defined contribution plan funded solely by the bureaucrats’ contributions from their pay as is common practice everywhere else. Even a small plan like the township’s can cause major financial problems for the township or the retirees down the road, which is why private sector companies do not offer it.

A defined contribution plan (like 401k, etc.) would at least keep the taxpayers off the hook in the event of a stock market crash.