ANSWER (Judy)

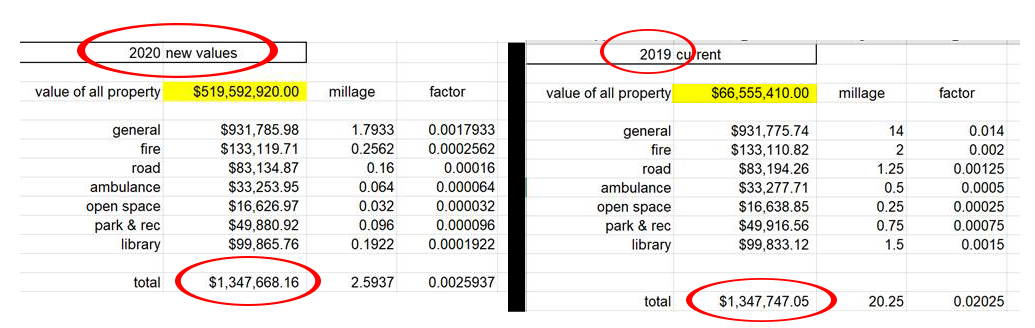

For the new millage rates, the township generated taxes that would equal as close as possible those billed in 2019:

The totals I show are approximate and may differ slightly from what is billed due to rounding, etc. but you can see that the new mills generate the same tax as the former millage.

The value of all the properties in Barrett Township increased from $266,221,640 ($66,555,410 x 4) to $519,592,920, almost doubling.

This explains why some people will see a decrease in their Barrett Township property tax if their particular property’s value increased by less than that.

Editor's Note:

'Millage' also applies at the school board and county levels.